Sheriff Sales Explained: Solutions & Support from NEA.

Homeownership can bring unexpected challenges, and one of the most distressing situations for homeowners is facing a Sheriff Sale. This process, often initiated due to mortgage foreclosure or tax liens, can be daunting. However, there are proactive steps and strategies available that may help homeowners stop a Sheriff Sale and regain control of their property.

What Is A Sheriff Sale?

A Sheriff Sale is a public auction conducted by law enforcement to sell property to satisfy a court order on a lien, typically arising from unpaid debt. This debt can stem from two primary sources:

Mortgage Foreclosure: When mortgage payments become delinquent, lenders initiate foreclosure proceedings. If the process goes through the court system (judicial foreclosure), a judge may order a Sheriff’s Sale to recoup the owed funds by selling the property.

Unpaid Tax Liens: Property taxes are crucial contributions to local governments. If these taxes go unpaid for a prolonged period, the government may seize the property and sell it at a Sheriff’s Sale to collect the back taxes.

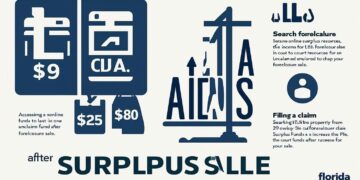

At the Sheriff’s Sale, the property is sold “as-is,” meaning the buyer takes responsibility for any existing issues with the property. The proceeds from the sale are used to pay off the outstanding debt, with any remaining funds going back to the original owner. These remaining funds, if any, are referred to as surplus funds.

Understanding Your Options

When confronted with a Sheriff Sale, homeowners have several potential avenues to explore:

1. Reaching an Agreement with the Lender: Communication is key. Homeowners can contact their lender to discuss possible solutions to avoid foreclosure:

Reinstatement Plan: This involves a lump-sum payment to bring the mortgage current, covering all past-due amounts. This option requires significant financial resources but can prevent foreclosure proceedings.

Loan Modification: A more sustainable approach, loan modification involves adjusting the loan terms to make monthly payments more manageable. This might mean lowering the interest rate or extending the loan term.

2. Paying the Judgment in Full: If financially viable, paying off the entire judgment—including principal, interest, late fees, and legal costs—can effectively halt the Sheriff Sale process. This option requires substantial financial resources but can provide immediate relief from impending foreclosure proceedings.

3. Filing for Bankruptcy: Bankruptcy filing triggers an automatic stay, which immediately halts all collection activities, including Sheriff Sales. This legal action offers homeowners the opportunity to reorganize their finances under court supervision. It provides a temporary reprieve from foreclosure proceedings and allows time to explore restructuring debts through a repayment plan or liquidation of assets.

4. Selling to an Investor: Selling the property to an investor, such as National Equity Agency (NEA), presents an alternative solution. Investors can purchase the property, settle outstanding debts, and potentially provide the homeowner with remaining equity, surplus funds. This option can be expedient, providing a quick resolution to financial obligations and avoiding the complexities of foreclosure.

5. Intercepting before Sheriff auction with NEA’s Expertise: National Equity Agency specializes in assisting homeowners with various foreclosure scenarios, including helping them explore options to potentially prevent their property from going to a Sheriff’s Sale. For accurate and up-to-date information on this complex topic, NEA strongly recommends consulting with a qualified foreclosure attorney to understand the legal steps and implications involved.

Important Considerations and Expert Guidance

It’s important to note that each option to stop a Sheriff Sale comes with its considerations and implications. Homeowners are strongly advised to seek guidance from qualified professionals—such as foreclosure attorneys or financial advisors—to assess their specific circumstances and determine the best course of action for their situation.

Getting Started with NEA

For homeowners seeking assistance with halting a Sheriff Sale or a rapid surplus refund, National Equity Agency offers a streamlined process. Interested parties can visit NEA’s official website at https://www.nationalequityagency.com/ or contact their office directly at +1 765-896-5281 to schedule a consultation and explore available options tailored to their needs.

Legal Department

National Equity Agency

+1 765-896-5281

email us here

Visit us on social media:

Facebook

LinkedIn

Instagram